Not all Families are in a position to help, that’s why NeighborWorks created the NeighborWorks Southern Colorado Shared Equity Homeownership Program.

NeighborWorks is committed to making homeownership affordable and attainable for low- and moderate-income families using the NeighborWorks Southern Colorado Shared Equity Homeownership Program (NWSoCo SEHP) through deed restriction.

What is Shared Equity?

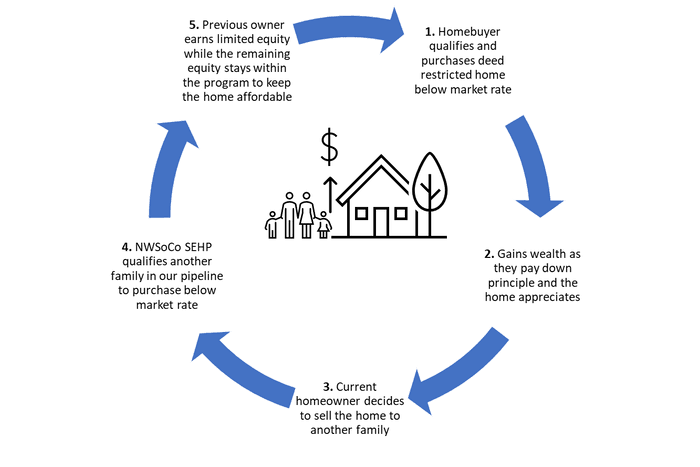

“Shared equity homeownership is a self-sustaining model that takes a one-time public investment to make a home affordable for a lower-income family and then restricts the home’s sale price each time it is sold to keep it affordable for subsequent low-income families who purchase the home.”

Source: Grounded Solutions Network, www.groundedsolutions.org

The first family builds wealth and then “pays it forward”

What are the advantages of using NeighborWorks Shared Equity Homeownership Program (NWSoCo SEHP)?

- The ability for low to moderate income (LMI) buyers to qualify and purchase homes at a lower price and become homeowners while building personal wealth from equity that grows due to owning their home.

- This is a responsible use of public investments, allowing them to go further and grow over time, helping family after family achieve homeownership.

- Strengthens communities by ensuring long term affordable homeownership opportunities for years to come.

- Provides stability, reducing overall and financial stress for households

How does Shared Equity work?

Pueblo’s family-first mentality has been using a form of shared equity for generations to help families purchase their homes. Parents and Grandparents have often helped their children and grandchildren purchase homes by providing their own funds (Equity) towards the home in the form of a down payment. Generally, the family expects the financial assistance to be paid forward and continue to grow in generational wealth; helping families to become more fiscally secure and overall improve stability. This is what we call “Shared Equity”.

Program Requirements

Each home within the program has its own income requirements as defined by HUD and will be identified in the home listing.

- Completion of a first time homebuyer and Shared Equity homebuyer class as approved by the Program Manager.

- Must Qualify for a first mortgage loan

- Home must be owner occupied, restrictions apply

- Household size must be appropriate for home

- Homeowner must agree to all restrictions

- May not own another home at time of purchase

- Must be a first-time homebuyer as defined by HUD

See below chart for reference or view HUD income limits here

First Deed Restricted Shared Equity Home Sold in Pueblo, CO

NeighborWorks Southern Colorado is pleased to celebrate the closing of the first Deed Restricted Shared Equity home using the model deed restriction created by Ground Solutions Network out of Washington, DC. While Shared Equity has been around for years, this particular model was created in 2021 by Grounded Solutions with the help of Fannie Mae and Freddie Mac to create an affordable homeownership model that lenders could then sell on the secondary market, opening up many different lending options to the homebuyer.

NeighborWorks Southern Colorado, located in Pueblo, CO, was fortunate to receive technical assistance from NeighborWorks America through a Shared Equity Grant to work with a Grounded Solutions Network Consultant who assisted us with modifying the model deed restriction to fit the needs of our organization while still serving the best interests of the families we serve. Soon after finalizing, what is now known as the NeighborWorks Southern Colorado Shared Equity Homeownership Program, we received our Duty to Serve certification, placing our program on Fannie Mae Connect, as a certified program that meets the shared equity homeownership definition in the FHFA Duty to Serve rule.

NeighborWorks Southern Colorado hosted several Shared Equity lunch-and-learn sessions and educated local lenders, realtors, and title companies of our program. After partnering with local lender Thrive Mortgage, ensuring full understanding of the Shared Equity Program, we began the process of approving the first homebuyer and getting a full understanding of the underwriting process that is involved with purchasing a Shared Equity home. With the help of Grounded Solutions, Fannie Mae, Freddie Mac, Land Title Guarantee Company in Pueblo, and Thrive Mortgage, NeighborWorks Southern Colorado successfully closed on this home May 11, 2023! We believe this model of Shared Equity is not only beneficial to the organization by way of expanding our portfolio, but also to homebuyers as they look for safe, affordable homeownership opportunities and create a wealth building mechanism that is not possible through renting. Deed Restricted Shared Equity programs that can be sold on the secondary market, provides the opportunity for large scale affordable homeownership opportunities throughout the country.

The Jones Family Pictured left to right: April Jones, Wynter Jones, Dan Jones

Creative Affordability

In May of this year, NWSoCo sold its first Deed Restricted Shared Equity home using a model that was created in 2021 by the Federal Housing Finance Agency (FHFA), and accepted by Fannie Mae and Freddie Mac, to create an affordable homeownership model that lenders could then sell on the secondary market, opening many different lending options. This model of Shared Equity is not only beneficial to the organization by way of expanding the portfolio, but also to homebuyers as they look for safe, affordable homeownership opportunities and create a wealth building mechanism that is not possible through renting.

Thursdays closing at Land Title Guarantee Company, combined the NWSoCo Shared Equity Homeownership Program, as well as the organizations Self-help Homeownership Opportunity Program (SHOP) and Down-Payment Assistance (DPA) program.

The SHOP program allows first-time LMI homebuyers to contribute 50-100 hours of labor or “sweat equity” toward the construction or rehabilitation of their home in exchange for equity into the purchase of their home. The DPA program provides a low-interest loan up to 20% of the purchase price for eligible LMI families. These programs contribute to affordability by either reducing the purchase price of the home, reducing the overall monthly payment, or lowering the amount in which an LMI family needs to qualify for in order to purchase a home.

“The growing affordability gap makes it essential to combine multiple subsidies to create opportunities for wealth building for families traditionally locked out of homeownership. This closing is the first step toward creating a model that can be replicated on a larger scale, making homeownership attainable for all.”, said CEO Ashleigh Winans.

All three of these programs will be available for use in Pikes Peak Park, a 600+ unit, mixed-use, mixed-income development that is being developed by NeighborWorks Southern Colorado on Pueblo’s west side. The development, which broke ground in May, aims to provide affordable homeownership opportunities to LMI families while including market rate homes, commercial space, community buildings, and over 15 acres of public parks and green space.

We’d like to thank the local team of Pam Gonzales with Thrive Mortgage, Micki Catalino with Land Title Guarantee Company, Marlene Berrier with RE/MAX of Pueblo, Inc., Deanna Westerby with RE/MAX Associates, and many others, in working together to make the dream of homeownership a reality for Mrs. Jones and her Family.

Our Impact This Year

-

Individuals Served Through Food Initiatives

4,410

-

Families Educated

2,333

-

Homeowners Created

514

-

Dollars in Small Business Lending

$3,511,920

-

Dollars Invested Into Communities

$166,123,216

-

Dollars in Down Payment Assistance

$2,032,920

-

Homes Preserved

186